Melvin Gold Consulting | ‘Hilltop’, Carroll Hill | Loughton, Essex | IG10 1NL | Tel: +44 (0) 7906 630187 | Email: melvin.gold@melvingoldconsulting.com

Quantification of serviced accommodation supply in the United Kingdom and consideration of related issues

Melvin Gold Consulting Ltd prepared a 2nd edition of our report exploring the current situation of serviced accommodation supply in the United Kingdom on behalf of its client Travelodge. The first report was prepared in 2008 and this revised edition is dated March 2011. Travelodge have kindly agreed to make this research available in the public domain. Highlights are: To download the full 2011 report, click here For updated data (to end 2017) from Spotlight on Hospitality 2019 click hereHotel Closures

Over 40,000 hotel rooms have closed in the UK since 2003. Research conducted by Melvin Gold Consulting has revealed that over 40,000 UK hotel rooms have closed since 2003 - the majority being small unbranded independent properties in coastal areas such as Cornwall, Blackpool and Torbay. The study indicates that at least 40,004 rooms have closed in 2,150 hotels – an average size of 18.6 rooms per property. Our most recent data on this topic including regional breakdown was included in this article written for Hospitality Digest 2014The value of hotel construction in the United Kingdom

In an article published in the British Hospitality Association's Trends and Developments 2012 publication, Melvin Gold Consulting Ltd, in collaboration with International Management & Construction Consultants Gleeds, undertook an estimate of the value of construction activity in the UK hotel sector in the decade from 2003. Using the BHA's database of new openings, rebrandings and major refurbishments we estimated that the value of construction was £12.425bn and taking account of professional and related fees and the value of land is likely to exceed £20bn. This excludes the regular capital invested in the upkeep and maintenance of hotels. The full article can be downloaded by clicking here. Further supporting information including breakdowns by brand, location (region and major cities), hotel category and can be downloaded here. For updated data (to end 2013) from Hospitality Digest 2014 click here

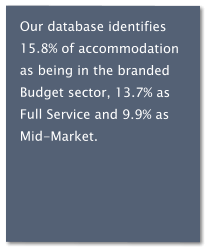

At the end of 2010 some

115,196 rooms in the UK

were in the budget sector,

some 15.8% of total UK

serviced accommodation.

The largest four budget

hotel companies operate

over 84% of segment

supply.

At the end of 2010 some

115,196 rooms in the UK

were in the budget sector,

some 15.8% of total UK

serviced accommodation.

The largest four budget

hotel companies operate

over 84% of segment

supply.

Melvin Gold Consulting | ‘Hilltop’, Carroll Hill | Loughton, Essex | IG10 1NL | Tel:

+44 (0) 7906 630187 | Email: melvin.gold@melvingoldconsulting.com

Quantification of serviced accommodation supply in the

United Kingdom and consideration of related issues

Melvin Gold Consulting Ltd prepared a 2nd edition of its report exploring the current situation of serviced accommodation supply in the United Kingdom on behalf of our clients Travelodge. The first report was prepared in 2008 and this revised edition is dated March 2011. Travelodge have kindly agreed to make this research available in the public domain. Highlights are: To download the full 2011 report, click here For updated data (to end 2017) from Spotlight on Hospitality 2019 click hereHotel Closures

Over 40,000 hotel rooms have closed in the UK since 2003. Research conducted by Melvin Gold Consulting has revealed that over 40,000 UK hotel rooms have closed since 2003 - the majority being small unbranded independent properties in coastal areas such as Cornwall, Blackpool and Torbay. The study indicates that at least 40,004 rooms have closed in 2,150 hotels – an average size of 18.6 rooms per property. Our most recent data on this topic including regional breakdown was included in this article written for Hospitality Digest 2014The value of hotel construction in the United Kingdom

In an article published in the British Hospitality Association's Trends and Developments 2012 publication, Melvin Gold Consulting Ltd, in collaboration with International Management & Construction Consultants Gleeds, undertook an estimate of the value of construction activity in the UK hotel sector in the decade from 2003. Using the BHA's database of new openings, rebrandings and major refurbishments we estimated that the value of construction was £12.425bn and taking account of professional and related fees and the value of land is likely to exceed £20bn. This excludes the regular capital invested in the upkeep and maintenance of hotels. The full article can be downloaded by clicking here. Further supporting information including breakdowns by brand, location (region and major cities), hotel category and can be downloaded here. For updated data (to end 2013) from Hospitality Digest 2014 click here

At the end of 2010 some

115,196 rooms in the UK

were in the budget sector,

some 15.8% of total UK

serviced accommodation.

The largest four budget

hotel companies operate

over 84% of segment

supply.

At the end of 2010 some

115,196 rooms in the UK

were in the budget sector,

some 15.8% of total UK

serviced accommodation.

The largest four budget

hotel companies operate

over 84% of segment

supply.